Big Nonprofit Ideas for the Other 95%

I love our new sponsor!

Do you want to find more prospects & raise more money? Pursuant is a full-service fundraising agency, leveraging data & technology.

Listen Live or Archive:

- On Fridays at 1pm Eastern: Talking Alternative Radio and tune in.

- Listen to the August 7, 2015 archived podcast.

My Guests:

Tom Wassel: Labor Law

Attorney Thomas Wassel, partner at Cullen and Dykman, says nonprofits often make mistakes around employee versus independent contractor (it’s not enough to pay them by invoice!) and when bringing in volunteers and interns. We’ll keep you on the right side of the law. (Originally broadcast on June 6, 2014)

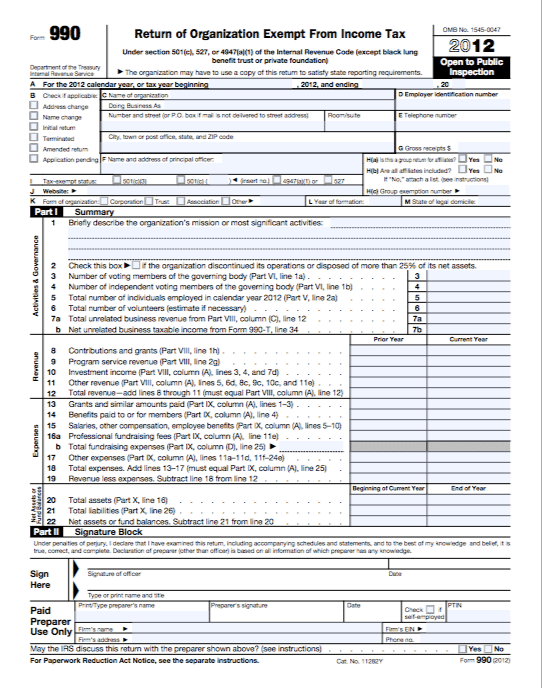

Yigit Uctum: IRS Helps Your Marketing

Yigit Uctum is a CPA with Wegner CPAs. He’s got ideas for using your IRS Form 990 in your marketing. See, it does have a purpose. (Originally broadcast on September 12, 2014)

Top Trends. Sound Advice. Lively Conversation.

You’re on the air and on target as I delve into the big issues facing your nonprofit—and your career.

If you have big dreams but an average budget, tune in to Tony Martignetti Nonprofit Radio.

I interview the best in the business on every topic from board relations, fundraising, social media and compliance, to technology, accounting, volunteer management, finance, marketing and beyond. Always with you in mind.

Sponsored by:

Processed on: 2018-11-11T23:22:22.359Z

S3 bucket containing transcription results: transcript.results

Link to bucket: s3.console.aws.amazon.com/s3/buckets/transcript.results

Path to JSON: 2015…08…252_tony_martignetti_nonprofit_radio_20150807.mp3.838865216.json

Path to text: transcripts/2015/08/252_tony_martignetti_nonprofit_radio_20150807.txt

Hello and welcome to tony martignetti non-profit radio big non-profit ideas for the other ninety five percent. I’m your aptly named host. Oh, i’m glad you’re with me. I’d grow a ganglion cyst if you handed me the thought that you missed today’s show labor law attorney thomas was cell partner at cullen and eichmann says non-profits often make mistakes around employee versus independent contractor it’s not enough to be paying them buy-in voice and when bringing in volunteers and interns, we’ll keep you on the right side of the law. This was originally broadcast on june sixth last year, and iris helps your marketing heat coach. Tomb is a c p a with wagner cpas. He’s got ideas for using your form? Uh nine ninety in your marketing. It does have a purpose that was originally broadcast on september twelfth. Twenty fourteen so today, it’s law and taxes which on non-profit radio are never boring on tony’s take two. Start your plan e-giving here responsive by pursuant full service fund-raising you need more prospects, they’re smart technology will find them pursuing dot com here is tom marcel and labor law. I’m very glad that subject of labor law for non-profit springs tom will sell to the studio. He’s, a partner in the law firm cullen and dyckman in garden city, new york. And in new york city, he’s been advising employers on a wide range of labor and employment law matters since nineteen eighty three. He is president elect of the long island, new york chapter of the labor and employment relations association. Thomas l welcome to the studio. Nice to nice to be in your studio, tony. Good to see you here. I’m glad we could do it face to face. So employees versus independent contractor, it turns out, is not enough to just pay somebody buy-in voice. And then, while love they’re they’re an independent contractor. That’s absolutely enough if you want to get into trouble. But it’s not enough if you want to do it right. Okay, basically, whenever one person is performing services for another person or another company, the presumption is that there are an employee and that with everything that that entails, including federal taxes, state taxes, worker’s compensation benefits, unemployment insurance benefits, employee health benefits, things like that in order for them to be classified properly as an independent contract that there’s a number of tests that they need to meet and if they don’t meet those tests and accompany miss classifies employees big trouble with the department of labor. Okay, we’ll talk about the misclassification ramifications, and so now we’re talking about federal and state, the the where where is this test? This test is from the i r s and then and then well, is that the eleven points is that from the irs? Absolutely the irs the internal revenue service has an eleven point test, which is used for determining whether or not you have to take out taxes from people’s wages, okay, but every state also has its own version of the test. They’re they’re pretty similar, but in terms of whether or not you need to contribute for worker’s compensation benefits or unemployment insurance benefits, and they all apply pretty much the same type of tests to determine the employee status. Okay, so it sounds like you’re in pretty good shape if you’re following the irs test, which we’re going to talk about, but you still need to enquire at the state level or or you’re not, because you’re not a hundred percent safe if you’re doing. Following just the irs that’s, that’s absolutely true in other words, each state can have its own rules and merely complying with the federal law that that’s fine in terms of federal taxation. But certain states have have stricter rules with regard to treating people as independent contractors versus employees. So you need to see counsel in the state in which you practice. I practice in new york, so you know, my comments about any law would be limited to anything in new york state and federal law. Okay, we’ll stick with the federal with the caveat that you should check the state level, but you’re on your you’re well, on your way if you’re if you’re complying with the irs regs, i imagine, absolutely okay, okay, so are we these these eleven items? Eyes is basically around the relationship between the employed, the non-profit and the person doing the work. Absolutely the key elements in the test without without trying to go over check checklist abila talk on some of them were good, some of it’s, a degree of control that thie and i’m going to go. I’m going to use the term employer here, even though we may. Say it’s a contractual relationship, okay, but no, we’ll say or the employer of the company, the relationship between the company and the person performing the service is in an employment relationship. For example, the company tells the employees where to work, what time to show up what their duties are? Ah, and what do they report to who they’re going to supervise if they’re going to supervise anybody? Things like that in a relationship like that that’s that tends towards the employer employee relationship as opposed to an independent contractor for an independent contractor, you basically say here’s the job, here’s here’s, what i want you to accomplish, maybe cem general guidelines do it when you think it’s appropriate, although there may be deadlines set, but i’m not going to tell you how to do it. I’m not going to supervise you on a day to day basis. I’m not going to provide you with the materials to do it. You do it on your own and i’m simply going to pay you a fee, which is another important distinction there the fee basis versus an hourly or salary type basis? Okay, we’ll get to that. You you touched. On something that i want to explore a little bit, the place where the work is done. So you you can’t have the person always coming to your office to perform the work, know that you can’t have the person doing the work in your office. But it really that would depend on the nature of the work. For example, if, if you if you have employees doing the same work, and now you’re going to bring in somebody else from the outside to sit alongside your employees and do the same work, well, that’s an indicator not not it’s, not a single point test but it’s, an indicator of an employer employee relationship. Now, if this person has his or her own business on the outside, has business cards may work from more than one company at the same time, or one after another on it, since you’re simply hiring that outside company to perform services for a limited period of time, well, that it tends to lean more towards the independent contractor relationship. How do we balance these eleven? Which we’ll get into some detail about some of the others too? But is it ah, like majority, if you have, if you have six out of the eleven year okay, andi it’s going to go one way or the other based on a majority? Or how does it work? Well, there is no bright line test. Those lawyers like to say, i think to some extent you apply the duck test if it looks like a duck and walks like a duck, and quacks like a duck, it’s a duck it’s very fact specific and a trier of fact, whether it would be through the department of labor or worker’s compensation board or in a court of law would look at all of these factors and say, well, okay, the control factor tends to lean towards employees, but the independent company factor tends to lean towards independent contractor and way all of these factors together, and then come up with an answer. Okay, so these eleven points are are the things that iris is going to consider? This is what they’re going to look at, and they’re going to put it all together. And they’re going to make a decision. Absolutely. Okay. And i guess it would work similarly at the state level. Like when you mention department of labor. We’re talking about the state department of labor could be state of the state or the united states department of labor. There’s both and and they’re very interested because independent contractors aren’t entitled to overtime or minimum wage or anything like that. You you pay them a fee or you pay them. You pay a company a fee to do something and that’s. Fine. But if their employees and they work more than forty hours in a week, they’re entitled to overtime. Yeah, we may have time to get more into that. Right. Okay. Um, i think we will. Actually, um, what are some of the other side? The other factors in these in these eleven points? Well, as i mentioned it’s the ah it’s. How people are paid. Yeah. That’s a good one. Sorry. Let’s. Talk about that one. The fee versus fee versus salary. Right. Well, typically, an employee may get an hourly wage. May get a weekly salary. It’s generally, the relationship is often not always but often sort of. Open ended that is to say, we’re going to hire you, not necessarily for two week barrier or until you finish this job, but we’re going to hire you as an employee and keep you on, but we pay you on a pay check. Ah, as opposed to an independent contractor who would normally be paid through some voucher system or through through ah, obviously issuing a ten, ninety nine, which is the tax form for independent contractors and might be in a lump sum. It might be in regular payments, but it’s not based on number of hours worked or anything like that that again, depending on how you structure the deal, that would tend to lean more towards employees or more towards independent contractor. What about? I think you mentioned giving someone the tools to do the work so you shouldn’t be giving them ah, laptop tto do the work or or other things or certainly office space dedicated in the office? I mean, that’s tending to look like employment, right? When you’re giving them that stuff? Absolutely. If i say, come into my place of business and i’m going to give you everything you need to do. The job and you don’t have toe put anything on the table other than what i give you that’s the hallmark of an employee, as opposed to an independent contractor who brings their own knowledge, skills and tools to the table and does the job that you’re paying them to do. We’ll go out for a short break, and when we come back, tell marcel and i’m going to keep talking about this and then we’ll get into volunteers and interns, and then i believe we will have time to for overtime for employees you’re supposed be paying your employees overtime. Do you maybe want to turn this off? If you’re listening in the office on monday, only the bosses want to hear this. We’ll get into all that stay with us, you’re tuned to non-profit radio tony martignetti also hosts a podcast for the chronicle of philanthropy fund-raising fundamentals is a quick ten minute burst of fund-raising insights published once a month. Tony’s guests are expert in crowdfunding, mobile giving event fund-raising direct mail and donor cultivation. Really, all the fund-raising issues that make you wonder am i doing this right? Is there a better way there is find the fund-raising fundamentals archive it. Tony martignetti dot com that’s marketmesuite n e t t i remember there’s, a g before the end, thousands of listeners have subscribed on itunes. You can also learn maura, the chronicle website, philanthropy dot com fund-raising fundamentals the better way. Like what you’re hearing a non-profit radio tony’s got more on youtube, you’ll find clips from stand up comedy tv spots and exclusive interviews catch guests like seth gordon. Craig newmark, the founder of craigslist marquis of eco enterprises, charles best from donors choose dot org’s aria finger do something that worked. And levine from new york universities heimans center on philanthropy tony tweets to he finds the best content from the most knowledgeable, interesting people in and around non-profits to share on his stream. If you have valuable info, he wants to re tweet you during the show. You can join the conversation on twitter using hashtag non-profit radio twitter is an easy way to reach tony he’s at tony martignetti narasimhan t i g e n e t t i remember there’s a g before the end he hosts a podcast for the chronicle of philanthropy fund-raising fundamentals is a short monthly show devoted to getting over your fund-raising hartals just like non-profit radio, toni talks to leading thinkers, experts and cool people with great ideas. As one fan said, tony picks their brains and i don’t have to leave my office fund-raising fundamentals was recently dubbed the most helpful non-profit podcast you have ever heard. You can also join the conversation on facebook, where you can ask questions before or after the show. The guests were there, too. Get insider show alerts by email, tony tells you who’s on each week and always includes link so that you can contact guess directly. To sign up, visit the facebook page for tony martignetti dot com. Dahna welcome back to big non-profit ideas for the other ninety five percent. Let’s, send some live listener love arco, idaho and orlando, florida live listener love to you very glad you with us let’s, go abroad! Seoul, korea manu haserot, islamabad, pakistan i’m sorry. I don’t know how to greet you in, uh in is it pasha pashtun? Passion is that i’m not sure what, but live listener love to you in islamabad, irrespective of how i would say it in your in your tongue, in your language bonem changing china, always welcoming the chinese lots of listeners. Ni hao, nagoya and tokyo, japan sending you konnichi wa and there are others we’ll get to them kuwait also, i wanted to get to kuwait. Um attorney thomas l let’s see if you’re if you’re the person who’s doing the work is getting their income from a bunch of different places. Is that that’s that’s? One of the factors, isn’t it that’s, clearly one of the factors, and and that would certainly militate or tend towards a finding of an independent contractor relationship? If you hire a company, the company may have its own letterhead may have its own invoices may have its own business cards may have an ad in the yellow pages for those of us who still actually use paper yellow pages or maybe a gn internet list thing nowadays. So if you hold yourself out as an independent company and maybe even filed company tax returns on have a company workers compensation policy, things like that that again would lean towards the independent contractor relationship rather than employees. If you are ah found by the irs to have misclassified people doing the work, would you expect that the irs is going to report to your state department of labor that they’ve found a misclassification? That’s, that’s a really good question, and i get asked that those kinds of questions a lot from lots of different employers, i tend to represent employers, and my understanding is no, they don’t necessarily do that. That particularly if you settle the case, the words that come to you and say you messed up, you need to pay x amount, and if you settle it voluntarily, they’re not going to go broadcasting it to the world so that there could be more agencies to come and knock on your door, because that would discourage you from settling in the first place that’s not to say that other agencies won’t find out about it. And certainly if the case were public, if you would have to go to court, which is a public record and other agencies saw that they could be knocking on your door as well, where do you see employers messing up? Well, it’s again, it’s the any of any of these factors will any or any role these factors? I have clients, and obviously i’m not going to mention names. Uh, i brought you for so it’s um, provocative, the name dropping. All right, i thought i’d like to keep practising law for a few more you’re not retired, they yeah, i have i have clients that have they’ll bring people in and they treat them as independent contractors and they say, well, they’re only going to be here for two months. I’m hiring them for a special project and i say yes, hiring see, that was the key word there on it doesn’t matter if you’re hyre it is a temporary employee or a permanent employee that’s one factor, but not not controlling temporary employees, their employees, so you have to treat them as contractors, and i’ve had a number of audits fromthe state workers compensation, border unemployment insurance division that come in and say you’re not paying premiums to these people because you’re not treating them as employees. Pay up. What? What are the penalties let’s talk about the federal level? What would you expect from the irs if ur misclassifying? Well again? In most cases, if if you own up to the to the mistake, you’ll certainly have to pay what’s owed but safe for the i r s not only will you have to pay what the employers share of the taxes wouldn’t really be, and they also have to pay the employees share of the tactics so security taxes that should have been paid exactly pay both the employer and the employee because the employer messes up, the irs isn’t going to go to the employees and say, by the way, some of that money you got, we want you to give some of it back. It’s, the employer’s responsibility to properly pay the employees. Okay, so the back taxes that were owed, what else? What else might be expect? Well, there, there could be civil penalties involved to or if it was done knowingly over a long period of time, with no knowing that you were violating the law usually second or third offenders, there could be some more severe penalties involved as well, you’re always welcome teo disagree with young arrests, right on contest there, their belief that you’re misclassifying absolutely, you know, just just cause the irs says so doesn’t make it so. But the presumption is that these people are employees, right, and it’s up to the employer to prove based on the law that these people are actually independent contractors. So if you if you want to fight them, you better have a pretty good case. Let’s move teo volunteers and interns what? What are what are non-profits often getting wrong around these? Well, the good news for not for not-for-profits we call them not-for-profits in new york, but non-profits same, the good news for non-profits is that you’re allowed tohave volunteers in the in the in the in the for-profit sector, you basically can’t have volunteers. Anybody who does work for you has to be paid, but in the in the nonprofit sector, you can’t have volunteers, but there are some rules about that as well. The work that’s being volunteered for can’t be the same kind of work that’s otherwise being done. In other words, you can’t have a paid clerical person sitting at a desk and then have somebody else come in and say, well, i’m going to volunteer and i’m going to do the same work sitting side by side the paid pearl really? All right, so let’s, let’s taken example of that suppose closed. You have employees that are preparing mailings. You’ve got a five thousand piece mailing going out and you don’t hyre ah, male house, you’re doing it inside and you’ve got people stuffing in printing, stuffing envelopes, putting stamps on, and then you bring some volunteers in to do that same work side by side with employees. That’s that’s, not a volunteer. I’d be very concerned about that. If i was the employer and i if i was their attorney, i would be tell saying we need to take a long, hard look at this because again, people sitting side by side, some people are being paid. Some people are, quote, unquote, volunteering very dangerous situation, even if the volunteers volunteered. I mean, even if they walked in and they love the mission, they’ve said, i want to help you. How can i help? And you said, well, we could use ten hours on, you know, over the weekend to put this mailing together well not-for-profits tend to be generally charitable, religious or religious organizations and the servant public purpose and that’s why they’re allowed tohave volunteers to some extent, but to the extent that you’re basically just doing the same work as other employees and saying, i don’t want to get paid for it, the law doesn’t really sanction such things. Oh, my, okay, i got to take a little tension because you mentioned for-profit companies, and i’m interested in that on the intern side. What about all the unpaid internships that are coming right now? It’s, it’s, summertime, what about those? Well, and you read about them all the time in the paper about the irs or the part you read about them in the new york journal? I don’t not seeing it in the where i’m seeing in popular, more more general press well, you get for-profit ce are allowed to have interns, but not that you can’t just but but i had on somebody and say, hi, you’re an intern, you’re going to work for me and you’re not going to get paid that would be violating the minimum wage laws for, among other things, but somebody can provide an internship if under certain circumstances, if they’re getting some sort of academic credit from an outside institution, if they are getting some sort of actual training from you that’s not specifically tailored to your organisation, but but taylor to their field of study, if they understand from the outset that they’re not going to get paid and that’s an internship also, it has to be a relationship where i understand from the outset otherwise it’s indentured servitude you tell them you’re getting gonna get paid, then they don’t they don’t see a paycheck. That’s ah, there’s got okay. That’s clearly got to be rolled. Believe it or not that’s that’s what? I passed that spelled out there. They have to understand that somebody’s done it. Yeah, all right, on. And also, they’re supposed to actually, because they’re an intern and learning from you, they’re supposed to be, if if anything, and impediments to the business not ah. Bonus to the business. In other words, if the business says we’re going to hyre fifty interns to do all sorts of work for us and make money for us that’s not really a bona fide internship, the purpose of the internship, the primary purpose is to give training to the intern, not to make money for the company. And if it’s really a benefit to the company that’s one of the factors that will be looked at to say these air not truly entrance. Okay, thank you for taking little digression in tow. For-profit i love it, you know, you you have these answers on top, your head man xero no notes, which i admire, i don’t like i don’t like notes, really? I have notes, but it is just off the top percent wonderful. I’ve been doing it for thirty plus years. I know you start to learn it if that helps. Yeah, yeah. So let’s go back to the non-profit side there are so the general rule is that you can’t have unpaid work as volunteers, but then there are these exceptions that we were starting to get into right if it’s a bona fide organization charitable. Organization and people are truly coming and say, i want to lend a hand to do you were having were having a blood drive or we’re having a a special event, and i’m a community member i’m going to come in and volunteer to give some of my time to help you that’s a true volunteer, but again, if if they’re volunteering simply to do work that the company not-for-profits would otherwise be paying for that’s a problem, employees of the not-for-profits basically can’t volunteer to give away free work. That’s interesting. I wonder if that comes up much. I don’t know. Well, if you see it well, i haven’t seen it, but it’s addressed in a number of decisions or regulations where somebody’s tried it. Yeah, obviously what’s in there? Yeah, right. That’s. Interesting. Okay, if you haven’t, i’d say you have an employee working for enough for-profit and and and there’s some child care. You’re going to sit with some child kind of simple. I don’t want to use the term baby sitting because that sounds majority, but some sort of ah monitoring situation, which is not within the normal scope of that employees work. That might be okay for a volunteer for the employees, but certainly the employees can volunteer to do additional work that employees already getting paid for. And where do you see non-profits making mistakes around the volunteer and in turn, well, i get calls from from some of my not non-profits and so, you know, we’ve got we’ve got all these people are in here and, you know, they’re here for, you know, ten or fifteen hours a week doing all this stuff, and i say, really, what’s your first question was where something well, i say, well, what are they doing? Art? Do you have other people that you’re paying to do the same work? And they’re working side by side? Are there are these people already employed by you? Because if they are that’s major red flag on dh again, if they’re duplicating or substituting their substituting for paid employees, that’s, that’s a problem? We’ve got somebody who’s out on a totally leave elearning leave a family medical leave act type of leave, so they’re gonna be out for twelve weeks, so we’re gonna have a volunteer filling for twelve weeks, okay? Do you have a sound of a klaxon in? Here or, you know piela only like that. But that’s just my voice is all we have is scary enough. Thrill enough weak enough as it is. That’s very bad. So paternity leave maternity leave. You can’t have a volunteer filling in. You’re basically saying, i’m going to have somebody do the same work as a paid employee, but i’m not going to pay them. No lost don’t let you do that. All right? I think that’s very interesting. All right, so what do we do, teo? To remedy this. So when your clients are then calling and there, then finding out in this call that they’re they’re running afoul, what do we do next? Well, i tell them aside, i’m obligated to do as an attorney. You should change this and you should start treating people correctly going forward because every day that you’re in violation of the labor laws or the or the tax code is is a new problem. If you change things today or tomorrow and start treating people properly, pay them, then you don’t really have a problem. And by the way, all you have to do to comply with most laws is pay minimum. Wage and you know you don’t you could have people have clerical people making fifteen dollars an hour. I need somebody to fill in, and i’m just going to pay the minimum wage. You can do that, you just can’t pay him nothing. You can’t have them volunteer if they’re not truly bona fide volunteers, can you work out some alternate form of compensation besides, besides money? Like maybe they get some benefits of services from the organization, i guess sort of a barter arrangements, but i’m thing thinking of is that is that possible barter arrangements are legal, but their taxable i don’t represent any barter companies, but i happen to have a close friend who’s involved in a bartering company, and i know that when party a’s trading goods or services with party be, both sides are issued ten, ninety nines and and the company, the bartering company, will report that to the irs. So if you just say instead of paying you seven twenty five an hour, which is the federal minimum wage, it’s hyre in new york state and a lot of other states, but instead of paying you seven twenty five an hour for forty hours, which is with two, two hundred ninety eight dollars a week. I’m going to give you two hundred ninety dollars, worth of free food, that’s that’s a taxable event and frankly, it doesn’t comply with the law. The fair labor standards act, which is the federal law that requires people get paid, requires that you get paid in cash or the equivalent of cash, not in goods and services they’re certain deductions allowed, but not completely excellent. Now we’re talking about federal and state law here, a cz well around the volunteers and interns, absolutely okay, so we’re talking mostly federal, but with the same qualification you need to check about check what the standards are in in your state are you? Are you still pretty well on your way to compliance? If you’re if you’re complying with what the irs requires, like like we said over on the independent contractor side e, i would say, you know, qualified lee, if that’s a word, if you’re complying with the federal rules, you are more than likely quality complying with state rules, but i certainly can’t give that as a guarantee without taking a look at the state rules, understand? Okay, let’s, spend a little a little time. We’re just a couple more minutes on overtime for employees. What is the problem here that you see? Big problem is that certain employees aren’t being paid overtime because employers think they don’t have to. And the biggest fallacy, the biggest myth that i see is and and employers and employees both believed this is that if you paid a salary, you don’t get overtime that’s not true, you need to be paid a salary in order to be considered exempt from overtime, but on ly, certain employees performing certain duties are exempt from overtime the main ones. I don’t talk about those one of those executives, administrators or administrative xero and professionals, so if you’re ah not for-profit ifyou’re ah, counselor, a psychologist, psychiatrist, a professional you’re not in your pay and you’re paid on a salary you’re not entitled to overtime, but you may be a highly highly paid administrative person who works closely with management. You may be exempt from overtime, but if you are a lower levels let’s, say, clerical person lower simply on the orc chart. Not in terms of your worth, but and you’re you don’t. Have it a lot of discretion and control doesn’t matter if you paid on a salary you’re entitled to overtime. If you work more than forty hours in a work week and that’s not waivable, you can’t agree not to take it. You can’t enter into a contract dipped in blood notarized doesn’t matter. You have to get paid for all hours worked at time and a half and not less than time and a half. Pay attention to the labor law. Thomas l, a partner in the law firm of cullen c u l l e n and die kayman d y k m a n in garden city, new york and also in new york city. Thomas l thank you very, very much in my pleasure mine as well. Tony’s take two and irs helps your marketing coming up first. Pursuant, they do full service fund-raising from web based tools for most of our audience small and midsize non-profits two on site campaign counsel for organizations that need that pursuance ah, prospector platform finds donors in your database who are ready for upgrade these are the people who may be giving you twenty dollars a month, and they’re ready to give one hundred a month, or the twenty dollars, a year. You know they’re in there, but they’re not so easy to find. Prospector platform does that it finds thes upgradeable donors so that you’re focused on the people that you should be spending the most time with not people who aren’t willing and able teo upgrade. Therefore you raise more money. You find your upgrade prospects who are hiding in plain sight. Prospector platform is at pursuant dot com my video this week is start your plans giving program here there are lots of reasons why charitable bequests, which our gift in wills are the most popular planned gift. Ah, i tick off a bunch of reasons that make request marketing the way to start your plan giving program and for a small shop that may be where you stop perfectly respectable it’s all in the video and that is at tony martignetti dot com that’s tony’s take two for friday, seventh of august thirty first show of the year here is heat, coach, tomb and irs helps your marketing you touch tomb he’s, a senior manager at wagner cps, he has his mba master of accountancy and is a certified public accountant. He’s also a certified fraud examiner, he works exclusively with tax exempt organizations and oversees the firm’s form nine ninety nationwide preparation practice eat manages wagner’s, new york city office they’re at wagner cps dot com he’s here in the studio to talk about the irs and how it helps your marketing. Welcome to the show. Thank you. Thank you for having me here. My pleasure, it’s. Cool. Glad you’re in studio um, the form nine ninety this is i thought this was strictly a burden and something to be not avoid it. We can’t avoid it, but there’s something to be done and kind of put in the closet. You don’t think so well, you’re right. A lot ofthe organization leaders thinks that it’s a burden and actually it’s it’s a great opportunity for organizations to show the world that all the good things that they’ve done in the in the year, and then it’s also a good opportunity for them. Um, tell the words how validate their run and in the past this forest scene, justus the farm files it tires and on ly to be shown ah potential donors or anybody coming to your office and basically asking for it. And now it’s vital they available on the web, especially the most common is the guide star. And because it’s out there it it gives an opportunity for organization to the marketing tool ok, and not only guide store, but state attorneys general, a lot of them have them. Can a lot of organizations put the nine ninety on their site themselves? Yes, it’s a sort of transparency, for example, in new york every not-for-profits lee, just with new york that files annual report with the state off new york they’re nine ninety, along with their financial statements, are on their website. So your advice is to think of this as a marketing tool it’s an opportunity? Yes, so if you see it as just a burden, and as most organizations currently do and don’t get enough attention, it can potentially hurt you. So i think about is some organizations for some, organ says is true that the nine nineties seen more than they’ll annual report, but they spent all the time and energy on the annual report make it perfect, but they only spent maybe a fraction off the time to get the nine ninety ready for filing, and we’re gonna have some. Time to talk about this. But you even suggest that people beyond accountant’s contribute to the nine. Ninety their final way. We’ll have a chance to talk about that. That’s. I love that advice. Okay, let’s. Just make sure that everybody understands what we mean. Nine, ninety, there are there are three nine nineties and you’re the expert. So when were you acquainted with the three? Yeah, the. Depending on the size ofthe organization, the organizations can file three different ninety forms. If they are under fifty thousand dollars in revenue. What they can do is they can file a form called nine ninety and which is also known as the postcard return and it’s, just basic information and a statement saying that the revenues were less than fifty thousand dollars. Okay, and with some states like new york, if you are over twenty five, then you have to file the night. Nineties eve, which is the next step. So organizations that are in revenues under two hundred thousand and in assets under five hundred thousand, they can file this form nine ninety easy, which is a shorter form. And the larger organization about the threshold can fire. They have. To file the form nine. Ninety, which is longer so just like we have individual ten forties and ten. Forty easy. Exactly. Nine. Ninety and nine. Ninety easy and then also the nine. Ninety n write really small for the under fifty thousand dollars in revenue. Right? But you raise an interesting point. Sometimes. It’s state regulations that govern which nine. Ninety you have to submit is that is that right? Could you mention new york? Yeah, a certain threshold for the easy. Right. So you have to look to your state and also to the i r s exactly. Okay, exactly. We’re not talking about the nine, ninety filing requirements here. Just i digressed a little bit. We have talked about the nine, ninety in the past. Especially with with jean takagi. So you could find those shows in the past. But we want to focus on the nine, ninety as a marketing tool. And part of your advice is that even if you’re able teo file the shorter form, you might want to do one that’s the next level up. Exactly. It depends on the purpose ofthe how you’re going to use it. For example, if you are a small organization under fifty thousand dollars. You may want to file the nine. Ninety easy to get your nine ninety on guidestar. So or ah, a lot of foundations, for example. They would like you to stop mitt at nine. Ninety easy or a nine. Ninety with grant applications. And, um, that’s. Another reason why you may wanna files piled the longer form in this case. And if you are ah going after donors and even if you are a small organization, if you can show that guarding all these good covenant practices and all these other things is just like, well, run is a large organization. I think it’s also helps it, but it’s getting funds. But if you do not have a purpose, i think it always cost more time and money to file the longer form. So i think it has to be ah, i violated in for individual circumstances. Fair enough, but something to consider. And i just love the different perspective is what i wanted to have you on the show. Different perspective of the nine. Ninety that it’s, you know, as we said, it’s not just no longer just buried anymore, but to look at it as a zoo marketing tool and therefore has to be consistent with all your other the what is the traditional marketing tools, right? Exactly? Yeah, for example, you don’t want to confused the word with sending mixed messages if your annual report is saying one thing and if you’re ninety saying another thing than it confuses people. So that’s one ofthe reasons why certain parts ofthe the nine ninety should not be done prepared by the countenance. It should be prepared by people who is also preparing other other marketing materials. Excellent. Okay, so let’s, get into some of the different place is in the form nine. Ninety, where you see marketing opportunities, what’s the you like thea program service. Accomplishments? Yeah. Where? Where is that? Where will people find that? On the night that could be on the second page off for my love. I love that you’re a nine. Ninety expert. You he doesn’t. He does not have the nine, ninety here in front of him. Which is what, like seventeen pages or something leaves twelve o on the schedule. And then the school was one of my many more starita he does not have a nine. Ninety here in studio with me is so when i asked him, like, what section is it? Andi knows the page, so i okay, you have the expert here, all of that. All right. So, um, you know, your your practices nine nineties. I love it all right. To the program. Service accomplishments. Your program serves accomplished. Mons to page two. Part three. It’s beautiful. Basically, organisations get the chance here. This is like the free marketing or pretended to tell the world the all the great things that you have accomplished in the in the past year and latto off times despite tires. Instructions. This is one place iris helps you market, as you mentioned, is in the instructions i response you to be specific. They want you to use non financial data, but a lot of organizations just they see there’s a burden. So year after year, they repeat the same thing. And the and the nine ninety preparation is buried in their finance department or of the outside consultant who’s doing it right. And they just want to know when it’s done exactly what you can’t fill. You need a number for page four line. Ninety three i don’t know, like, you know, you probably rolling your eyes. Oh, my god, what an amateur question ninety three’s not on page four, for christ sake, but that’s just the thing is just buried until it’s ready for signature basically right? It’s? Not so who? So we can have program officers doing the program service accomplishment section or something like that, right? So basic, the its funding to say this take like a food pantry. It’s one thing to say that you have served meals to low income people in the community and it’s another thing toe give some more specific you can say piela, sir, different fifty thousand different people eighty thousand meals during the years, so it gives more, more basically more impact. And people are seeing this on guide star and on your website. And of course, it needs to be consistent with your other marketing material. Exactly. School what? What else? What other opportunities to see in that section? So i’ll give you another example of that because, like, if you’re a membership organization, try to use it to recruit members and you fear with conferences wanting to say you spent hundred thousand dollars in this conference is another thing to say. Our conference was attended by twelve hundred people. We had sixty different sessions. You can name some off the station, including x y z. And we also had to networking opportunities again like this is anything you can tell tow people join you as a member for a membership organization. And can anything that you see that would attract donors are whoever you are trying to calm me. It’s like. All right, cool. Very good governance. There’s the governance section is this the section on the nine. Ninety relieve the governance? Yeah. There’s a section on ninety nine on the nine. Ninety deaths as out ofthe questions about the governor inspection number part part six off your nine nine beautiful love, the basically in that part, it’s asking out ofthe question some of these questions, such as, um, whistle blower policy and document destruction policy. These can be mandated by others. Other ah um pre-tax sarbanes oxley. Examples on the other set is dahna lorts state law, right? And new york will start mandating certain certain policies there as well. And some off thes policies are very easy to add up. So their templates out there it’s not a huge burden, and i encourage every every organization, if do they do not have a policy out there, just go look for a sample adapted and checked the box yes to show that they’re they’re well, well run and well covered and thiss foot reduced the potential all at risk and it’s also important to use that affection toe basically solicit new board members because one off the users off this maybe perspective what members looking at your nine ninety to see if this is our organs and joe, i want to join this organization, are they so they know what they’re thinking? It might be exposed to any risk by joining terms. All right, we gotta go out for a break. You’re gonna do some more live listener love there’s so much i got to squeeze him in tuscaloosa, alabama welcome live. Listen, i’d love to you. I don’t think you’ve been with us before tuscaloosa welcome and jersey city, new jersey it’s, the birthplace of my my dad. He was born in greenville hospital, jersey city, new jersey, and langley, bilich british columbia. You’re back with us live listener left. All of you. We got some or stay with us. Like what you’re hearing a non-profit radio tony’s got more on youtube, you’ll find clips from stand up comedy tv spots and exclusive interviews catch guests like seth gordon, craig newmark, the founder of craigslist marquis of eco enterprises, charles best from donors choose dot org’s aria finger do something that worked and they only levine from new york universities heimans center on philantech tony tweets to he finds the best content from the most knowledgeable, interesting people in and around non-profits to share on his stream. If you have valuable info, he wants to re tweet you during the show. You can join the conversation on twitter using hashtag non-profit radio twitter is an easy way to reach tony he’s at tony martignetti narasimhan t i g e n e t t i remember there’s a g before the end he hosts a podcast for the chronicle of philanthropy fund-raising fundamentals is a short monthly show devoted to getting over your fund-raising hartals just like non-profit radio, toni talks to leading thinkers, experts and cool people with great ideas. As one fan said, tony picks their brains and i don’t have to leave my office fund-raising fundamentals was recently dubbed the most helpful non-profit podcast you have ever heard, you can also join the conversation on facebook, where you can ask questions before or after the show. The guests are there, too. Get insider show alerts by email, tony tells you who’s on each week and always includes link so that you can contact guests directly. To sign up, visit the facebook page for tony martignetti dot com. You’re tuned to non-profit radio. Tony martignetti also hosts a podcast for the chronicle of philanthropy fund-raising fundamentals is a quick ten minute burst of fund-raising insights, published once a month. Tony’s guests are expert in crowdfunding, mobile giving event fund-raising direct mail and donor cultivation. Really, all the fund-raising issues that make you wonder, am i doing this right? Is there a better way there is? Find the fund-raising fundamentals archive it. Tony martignetti dot com that’s marketmesuite n e t t i remember there’s, a g before the end, thousands of listeners have subscribed on itunes. You can also learn maura, the chronicle website philanthropy dot com fund-raising fundamentals the better way. If you have big dreams in a small budget tune into tony martin. Any non-profit radio ideo. I’m adam braun, founder of pencils of promise. Welcome back to big non-profit ideas for the other ninety five percent let’s, go abroad with live listener love belgium children, we can’t see your city! I thought that was a pretty open society. They’re belgium, but you’re you’re blocked but welcome live listen love to you, let’s, go to china, where i send ni hao to shanghai, chengdu, korea, multiple listeners in korea, as always, including soul, anya, haserot and japan, multiple listeners tokyo, akashi and others konnichiwa and, of course, podcast pleasantries to those of you listening in the time shift wherever you may be, ninety five hundred of you podcast pleasantries to you yeah, let’s, let’s keep talking about the governance section is that this is not a free form narrative section like the program service accomplishments, it it certain parts ofthe it are free form, for example, one off the question there is, like what’s. Your policy is to review the night ninety so in there you can explain, like how what process off leaving tonight ninety like does every boardmember sees the nine ninety who who looks at it, who prepares its who reviews it and how it gets wild, the other free form part. Is the conflict of interest policy. You can have different types. And who’s who’s monitoring. It goes who’s looking at it. And another part is the determination off the executive compensation. So what’s the policy around that looking at comparables like, do you have independent comity? Looking at it and documenting this decision? There are some some freeform parts over then within governments. Governance? Of course. Right. And we have talked about, i think, all those subjects that you just mentioned with with jean takagi when we’ve spent time on the appropriate governance and oversight. So this is a perfect dovetail. Um, how about you have something about the statement of functional expenses? Where will we find that? If we if we want to go into the nine ninety, um, that would be now little people. Nine off the ninety basically and, um, statement functional expenses. I believe you covered overhead. Mitt in in your previous shows, we have the we had the three signers of the overhead myth. That was on september sixteenth. The ceos of charity navigator, guidestar and better business bureau wise giving alliance. Yeah. So basically, i want to refer to that which is a great point they made and ah, out ofthe not-for-profits are too worried about their program service percentage and that, um, that they want to put like, as they reflect, i guess, everything they can in the program, and they should know that if it’s correct, so but sometimes like it gets to a point where they wanna look at things which is more like gray and, you know, they have the natural incentive to put more into program and not in management, general fund-raising and that doesn’t necessarily reflect the truth and ah, that’s area um, it’s sophisticated donor-centric e-giving and i ninety can tell that certain things are not correct there because certain things such as an audit, it has to be a hundred percent management general, accounting and audit is that, um so i think, it’s another point important here is that that schedule is done correctly so that a potential donor funders looking at it shouldn’t question anything accurate, so get on dh that one is the key. That was the whole message of the overhead myth letter is don’t feel you have to devote everything to to program at the expense of overhead, which can be very very important. Tisbury. So you have sophisticated people looking at your nine ninety, and you’re thinking of it as marketing. Keep that. Keep that in mind. We have to. We have just a couple minutes left. There’s a part of the nine. Ninety that you call a playground? Yes, that is that. That would be schedule. Oh, that’s a place where you can put anything that an organization can beat anything they want in there, so ah, i would use it as a, um what is it called? What is schedule? Oh, called, huh? I think it’s just called a schedule a it’s, like a supplementary information thinkit’s supplementary in formation. And basically, i would encourage organizations toe explain anything that might look unusual on the on the on the nine. Nineteen. Okay, for example, let’s say if they are starting a capital campaign and in that initial year they wouldn’t necessarily have to revenue yet, but they have all these fund-raising expenses. So if they’re fund-raising expense ratio is unusually high and this might be a place to explain that they’re going through the skips, the campaign and that they they’re also informing the public that they’re doing this. So it’s another place toe to use that for that. So outstanding, really interesting perspective on form nine ninety thank you very much. Thank you for my pleasure. You duitz doom senior manager at wagner cpas manager of their new york city office there at wagner cpas dot com next week will mccaskill, author of doing good? Well, no, i’m sorry. Doing well better now doing good, better that’s the book doing good better he’ll be on for the hour if you missed any part of today’s show finding on tony martignetti dot com where in the world else would you go? I did not forget live listen love all the live listeners who are out there can’t name you by city and state were pre recorded today, obviously, but you know the love is going out to live listeners podcast pleasantries, everybody listening in the time shift over ten thousand of you so glad you’re with us and it was very important affiliate affections to our affiliate listeners in stations throughout the country affections out to the affiliate listeners pursuant, find your upgrade prospects with prospector platform you’ll raise boatloads more money, and i’m not talking rowboats or kayaks. Or doory skiffs. We’re talking three masted schooners full of money. Pursuant dot com. Our creative producer was claire meyerhoff. Sam liebowitz is the line producer. Shows social media is by susan chavez at susan chavez. Dot com on our music is by scott stein. Thank you, scotty. Be with me next week for non-profit radio. Big non-profit ideas for the other ninety five percent go out and degree. Buy-in what’s not to love about non-profit radio tony gets the best guests check this out from seth godin this’s the first revolution since tv nineteen fifty and henry ford nineteen twenty it’s the revolution of our lifetime here’s a smart, simple idea from craigslist founder craig newmark yeah, insights or presentation or anything people don’t really need the fancy stuff they need something which is simple and fast. When’s the best time to post on facebook facebook’s andrew noise nose at traffic is at an all time hyre on nine am or eight pm so that’s when you should be posting your most meaningful post here’s aria finger ceo of do something dot or ge young people are not going to be involved in social change if it’s boring and they don’t see the impact of what they’re doing so you gotta make it fun and applicable to these young people look so otherwise a fifteen and sixteen year old they have better things to dio they have xbox, they have tv, they have their cell phones me dar is the founder of idealised took two or three years for foundation staff to sort of dane toe add an email address card? It was like it was phone. This email thing is right and that’s why should i give it away? Charles best founded donors choose dot or ge somehow they’ve gotten in touch kind of off line as it were on dh and no two exchanges of brownies and visits and physical gift. Mark echo is the founder and ceo of eco enterprises. You may be wearing his hoodies and shirts. Tony talked to him. Yeah, you know, i just i’m a big believer that’s not what you make in life. It sze you know, tell you make people feel this is public radio host majora carter. Innovation is in the power of understanding that you don’t just do it. You put money on a situation expected to hell. You put money in a situation and invested and expect it to grow and savvy advice for success from eric sacristan. What separates those who achieve from those who do not is in direct proportion to one’s ability to ask others for help. The smartest experts and leading thinkers air on tony martignetti non-profit radio big non-profit ideas for the other ninety five percent you’re tuned to non-profit radio tony. Martignetti also hosts a podcast for the chronicle of philanthropy. Fund-raising fundamentals is a quick ten minute burst of fund-raising insights, published once a month. Tony’s guests are expert in crowdfunding, mobile giving event fund-raising direct mail and donor cultivation. Really, all the fund-raising issues that make you wonder, am i doing this right? Is there a better way there is? Find the fund-raising fundamentals archive it. Tony martignetti dot com that’s marketmesuite n e t t i remember there’s, a g before the end, thousands of listeners have subscribed on itunes. You can also learn maura, the chronicle website, philanthropy dot com fund-raising fundamentals the better way, way.