Not sure if you have to file? Here’s help.

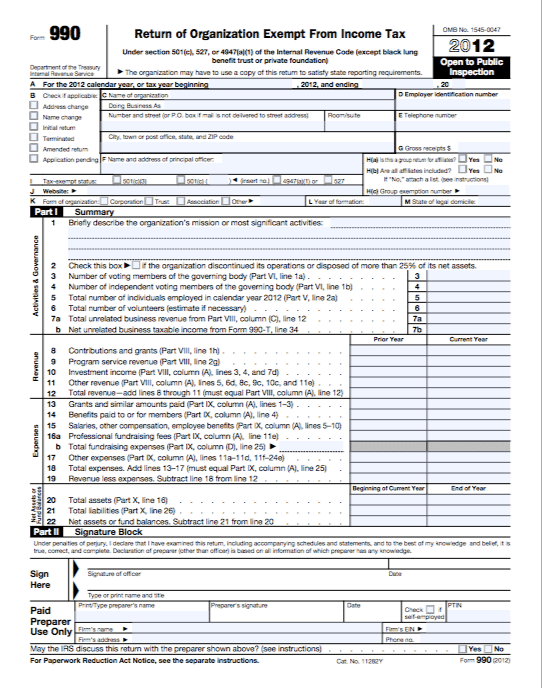

The form 990 filing deadline is four-and-a-half months after the close of your fiscal year. If your fiscal year ended on December 31, 2012, then your 990 is due by May 15th. The IRS expresses the deadline as “the 15th day of the fifth month” after close of your fiscal year.

Years ago, someone in a seminar was quite vociferous about how I was wrong to say four-and-a-half months. I couldn’t dissuade him. He wasn’t quibbling over “half a month” leading to the 14th of May.

He didn’t see the equivalence. I was polite.

Ninety-day extensions are granted automatically using form 8868. Typically charities need the extension because their previous year’s audit isn’t finished. Additional 90-day stretches aren’t hard to come by, but are not automatic. Use the same form, part II.

I’ve seen plenty of 990’s delayed for more than a year. That plays havoc, by the way, with charity registration deadlines in the states where you solicit donations. I know that work intimately. I wrote a book about it. I also published a paper.

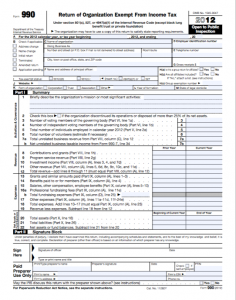

Not sure which form to file (990, 990-EZ, 990-N postcard)? Here’s help.

Important fine print: I am not your attorney or your accountant. Seek the advice of your professional advisors in all matters of IRS compliance.

Thanks for reassuring people, Paul. I’ll bet that 90 days goes fast.

Paniced because the deadline is tomorrow? Relax! As you mentioned, the IRS will grant a three month extension to any organization that requests one. Use Form 8868 and be sure to file it by the end of the day tomorrow.

Paul Konigstein

Senior Consultant

Accounting Management Solutions