Our regular legal contributors, Gene Takagi and Emily Chan of the Nonprofit & Exempt Organizations Law Group (NEO) answer these questions: how do you determine what’s reasonable compensation for executives? What happens if comp is excessive? What’s the automatic penalty that kicks in if you don’t disclose benefits? Plus, we’ll do a board role play. Let’s see who chairs the meeting. (This is from the Nonprofit Radio vintage archive. Last October was a very good month.)

You’re on the air and on target as I delve into the big issues facing your nonprofit—and your career.

If you have big dreams but an average budget, tune in to Tony Martignetti Nonprofit Radio.

I interview the best in the business on every topic from board relations, fundraising, social media and compliance, to technology, accounting, volunteer management, finance, marketing and beyond. Always with you in mind.

Transcript for 134_tony_martignetti_nonprofit_radio_20130322.mp3

Processed on: 2018-11-11T23:00:25.008Z

S3 bucket containing transcription results: transcript.results

Link to bucket: s3.console.aws.amazon.com/s3/buckets/transcript.results

Path to JSON: 2013…03…134_tony_martignetti_nonprofit_radio_20130322.mp3.719682707.json

Path to text: transcripts/2013/03/134_tony_martignetti_nonprofit_radio_20130322.txt

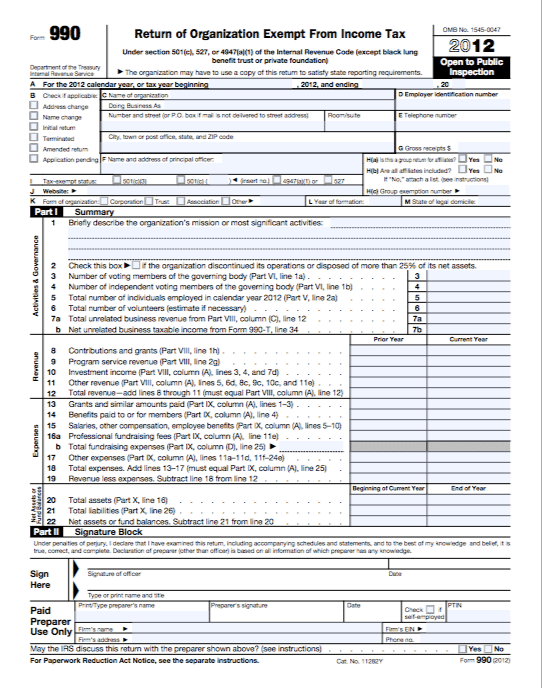

Hello and welcome to tony martignetti non-profit radio big non-profit ideas for the other ninety five percent you know me, i’m your aptly named host it’s friday, march twenty second i very much hope that you were with me last week don’t let me hear that you missed gary vaynerchuk. Gary shared insights and inspiration from his body of work and his book the thank you economy and amy sample ward and i talked about kindness, criticism and on honest online conversations this week i rs sale in aisle four o three b evan giller, founding member of the law firm of giller and calhoun, explains the i r s is fifty percent off the penalty sale for four o three b retirement plans that are not in compliance. Many plans are not up to code, and this is the year to fix those problems. We’ll talk about the common mistakes and what to do. Also compensation clarity a regular legal contributors jean takagi and emily chan of the non-profit and exempt organizations law group answer these questions how do you determine what’s reasonable compensation for executives? What happens if comp is excessive? What’s the automatic penalty that kicks in if you don’t disclose benefits plus, we’re going to do aboard role play, and we’ll see who chairs that meeting. This is from the non-profit radio vintage collection last october was a very good month between the guest today on tony’s take to my podcast for the chronicle of philanthropy that i do monthly fund-raising fundamentals, some details about that, my pleasure now to welcome evan giller he’s, a founding member of the law firm of giller and calhoun he’s worked on employee benefit plan issues, including retirement and executive compensation plans for over twenty years. He has extensive experience in plan, design and compliance and is a contributing author to the four o three b answer book. I’m very glad that his expertise bring us two brings him to the studio. Evan giller, welcome well, thankyou, tony, and very happy to be here. Pleasure. We’re all our lawyers, all lawyers and compliance issues today, but i’m going to keep you all of you on the straight, narrow, um, let’s start very basic so that we know that everybody i can figure out where they have a four o three b or they don’t. What is a four o three? B plan k so four o three b plan is a retirement plan that is only available to tax exempt organizations, not for-profit organizations or teo governmental organizations that are that are educational organizations like k through twelve public schools and state local universities and colleges. Okay, so the the reason that four o three b is in the code is because those types of organizations were deemed to need a very simple, fairly cheap way of providing retirement benefits to their employees. Now a tax exempt a charity could have, and we’re our audiences. The five oh one. See threes, no small and midsize charities. They could have some other kind of retirement plan for their employees. That that’s. Exactly correct. Until recently. Well, when i said recently, probably about the last twenty years, these types of organizations could not have a four. Oh, one k, but that’s not true anymore. They can have a four. Oh, one k as well or what’s known as a qualified for a one a plan. And i will keep the jargon to a minimum. A surgeon general has i know. Okay, is the rule but the ah that’s. A plan that although it’s under different section of the code looks kind of the same. It allows the employer to put in money on behalf of the employees accumulate amount that they could get when they when they were tired. Okay, so we have the former one case before oh, for a one. A cz. But we’re talking today about the four. Oh, three bees. Okay, what is the problem with some? I think maybe lots ofthe four o three b retirement plans. Right. So if i can i give you a little history here, please. On dh. We could go back far into the depths of the sun. Not too far from the nine hundred right? Stick by nineteen. Yes. Yes. But these plans were set up originally because it was perceived that college college professors could not retired because they don’t have enough teo enough money to retire on. And so these plans were set up, much like individual plans. Sort of like ira’s today. Individual annuity contracts were issued to the participants in the plans to the college professors. Ultimately, they were expanded to cover all five. Twenty three’s and these, you know, governmental educational organizations. And they were very lightly regulated for many years. And i should say that there are really two important regulators were talking about. As you said, we’re talking about the irs. We’re also talking about the department of labor and department labor also regulates these plans. And in the last since since nineteen, eighty six and on both of these organizations have decided that the four three v world was too big, too much like the wild west, but too big and needed to be increasingly regulated. Okay, so the plans became popular so popular that regulators got concerned about them. That’s, right? They became large, you know, with large for large tax exempt have giant plans on dso. The regulators did get concerned about them and wanted to make sure that they were being operated properly. Okay, because the ultimate concern is that we want to have money for the retirees that are participating in these plans. Exactly. And the other concern is that the three irises also two rules thes rules. Are they so the quid pro quo for the tax benefit that you get out of these plants? And the irs wanted to make sure that these rules were being followed. Properly. Okay, so rules are not being followed, and we have ah, we’ll get to this. But we have ah, we have a period where you can save some money on penalties for not following the rules. But what? What’s? The main problem is the, er, the plan’s. Right? So, okay, that’s, you and i introduce it, but you talk us through it. So the overarching issue here is that until two thousand nine, under the under the irs is rules. These plans weren’t required to have a document, a written plan that they had to follow, and a lot of these plans had they didn’t not have anything. But they had very sketchy documents because actually on the department of labor side, you were supposed to have a document as well. But nobody was looking too closely at it. And this is a document that it describes how your plan is goingto operate, right? So the document is you very often very detailed and it’s exactly how the planets to us to operate and also contains all the iris requirements. So in two thousand nine, thie iris the i recited set a deadline that by two thousand, by january first, two thousand nine every four three b plan with very narrow exceptions had to have this written document. This is the increased regulation that you were talking about it we’ll start to see. Okay, right. You had that january deadline, right? January two thousand nine deadline, right? And actually, in december of two thousand eight, justice everyone was scrambling to complete this deadline. The iris actually given extension to the entity. That’s. Nice. So it was a busy time for you when you got then you got eleven months. Reprieve. It was a fantastically exciting moment. Yeah, okay. Yeah, well, you were able to enjoy your holiday. It was in two thousand eight, although it wasn’t looking like you were going to exactly. Okay, so did they wait until december thirty first? They know one thousand deo, but was close. It was it was in the first week in december. It wass e-giving months. They like to suspense. Yeah. Yeah. So the but that deadline the end of two thousand nine came and went and held. And so all four o three b plants again. There are some very narrow exceptions. Had to have this written document adopted a formally by the organization by december thirty first, two thousand nine if you didn’t do that, you’re out of compliance. Your plan theoretically, the plan could be deemed to be failed failed very bad result. A failed plan means that all the money in it all of the contracts in that plan will be taxable. The contracts are all the all your employees that’s, right? Ok, that’s, right? So the so the danger of being out of compliance is what what’s what’s your employees going to suffer, they’re going to have a very bad tax consequence, and they go and they’re going to look to you as the employer, and they’re going to say, why did this happen? So the irs doesn’t like to invoke this nuclear penalty on plans very much disqualifying the disqualifying, pluck us, right? And so for a number of years, they have worked on a program that allows plans, and not just for three plants, but all kinds of retirement plans to correct errors so they don’t get disqualified. All right, so you were supposed to have been been had your plan document by december of two thousand nine, but since then they’ve been working. Tio get people into compliance because they know there are a lot that that didn’t make that deadline. That’s, right? Ok. And so they have said that the to the extent that you have failed to adopt, if you that you failed to adopt your plan on time by that deadline now att the end of last year they came out with a program the irs did. That said you khun submit ah, a plan document to the irs. Now pay a penalty and you will be absolved of having failed to meet the original deadline. Yes, you’re absolved. You brought into the fold. You’ll come to the flock, we will absolve you, but you have to pay a penalty. You are deemed to have to be in compliance. We have to pay a penalty. Okay. Okay. And that gets us to the fifty percent off no sale. So in two thousand and thirteen, if you have that one mistake and you could have other mistakes. But if you that one mistake that you veiled the plan document failed to adopt the plan document of time and you go in through this program, the irs is cutting the penalties in half for the course of the year. There’s. Your fifty percent off sale. It’s a sale. Okay, wei have just about a minute or so before before we take a little break. What? What needs to be? Well, first of all, you have to have your document, and then it has to be the documents to be correct. Is that right? Well, the actually when you go through this program, the irs is not going to give you an opinion as to whether the documents correct that’s. Another disney that’s. Another the process that we can talk about. You hear the irs just wants to see you have your organization has formally adopted the document. Okay, okay, all right. Why don’t we take that break? And when we come back, evan giller stays with me. He’s, a founding member of the law firm of giller and calhoun. We’re talking about the irs sale in aisle four o three b. Stay with us. Talking alternative radio twenty four hours a day. Are you confused about which died it’s, right for you? Are you tired of being tired? How about improving your energy strength and appearance home? I’m rika keck, holistic nutrition and wanda’s consultant. If you have answered yes to any of my questions, contact me now at n y integrated health dot com, or it’s, six for six to eight, five, eight five eight eight initiate change and transform your life. Are you concerned about the future of your business for career? Would you like it all to just be better? Well, the way to do that is to better communication, and the best way to do that is training from the team at improving communications. This is larry sharp, host of the ivory tower radio program and director at improving communications. Does your office need better leadership, customer service sales, or maybe better writing, are speaking skills? Could they be better at dealing with confrontation conflicts, touchy subjects all are covered here at improving communications. If you’re in the new york city area, stop by one of our public classes, or get your human resource is in touch with us. The website is improving communications, dot com, that’s, improving communications, dot com, improve your professional environment, be more effective, be happier, and make more money improving communications. That’s, the hey, all you crazy listeners looking to boost your business? Why not advertise on talking alternative with very reasonable rates? Interested simply email at info at talking alternative dot com durney welcome back, i wish i could send live listener love, but we are pre recorded its a few weeks before march twenty seconds. I can’t send live listener love, but you know that we do love our live listeners. Evan, you and i are talking about i’m goingto introduce something to save you from jargon jail because you probably wouldn’t set it this way. I like to i like, i like this the v c p for e p c r s is now we’re talking about the v c p for epi crs way r and i’m glad i didn’t say that you wouldn’t have because your prison well, i mean, sorry, practicing attorney or not, you know, jargon jail is open for you and would have had quite an impact when the board of bar examiner’s or the new york state bar association found out about your felony jargon jail. So i’m doing it v c p for epc rs what does that mean? Okay, so those air to acronyms that that describe the this correction program that we’re talking about s o a p c r s is the is the acronym for the overarching program the employees plan compliance resolution system. Thank you. S oh, every wrote that down, but known affectionately as cpc arrest everybody. And v c p is the one of the components of it voluntary correction program and that’s important that that one, though, is important too. Spend a little time what those words mean because it means that you’re turning yourself into the irs. You have found an error, and you’re turning yourself into the irs to correct that error for a reduced amount of a fee. But it’ll be lower than if they caught you. Right? Fifty percent lower, you know, know that something else is fifty percent. Is the sale on the v c p fee for this year? For that? For that non non compliance ever that we talked about? Okay, but in general document, right, but forgetting about this year forgetting with percent off if the irs catches you in violation, it’s going to cost you more than if you turn yourself in now. Really? That’s the basic theory. Okay. Yeah. Okay. Um all right. So we know that the dangers if you’re if you haven’t adopted your plan document and there and i realize there are other things that could be wrong with your four three beer. We’re gonna have time to talk about those two. You have top five, evans top five, but so far now we’re just talking about not having adopted your plan document by the two thousand nine deadline. Um, your employees will face taxation. You’ll be embarrassed. Your planned disqualified there’s penalties for that? Of course, if the irs finds it. Okay, so what do we do now? If we we haven’t adopted our plan document. How do we enter this thiss rehabilitation program? So the irs has come out with a kit, actually, a compliance kit on blast. Three weeks or so. That takes you through all of the steps that you need to follow in order to get into this program and submit and get. Okay. And this is your doing. This is an outpatient, right? You’re not inpatient rehabilitation, right? That it’s? Yeah, that you basically are it’s all by the male, you know, you send in a document, sent it. But there are a bunch of forms that you that you need to fill out on dh sometimes, you know, you might find that you there kind. Of complicated there, an irs speak and you may want a little help but basically it’s a set of forms that you sent in with your document on proof that your plan has been adopted. Okay, now, what needs to be in this document, this plant? What is in what the parts yet so for three b document has to contain, at the very least, all of the requirements in that code section for four o three b flat. So what does that include that includes limitations on contributions that the irs provide requires? In other words, the irs says you can’t put in a zillion dollars for some rich. I mean, you the employee the employer can play okay. Limits on contributions. Ok? And those of of your listeners who are friendly with four three plans no, actually, one of the one of the most valuable and appealing aspects of it. His salary reduction contributions by employees where you put in money on a salary on it before tax basis into the plan. Just like four. Oh, one k plan and their limits on that as well. And those very strict limits on how much, how much input in direct, which in two thousand thirteen and seventeen thousand five hundred dollars okay, there are requirements that everybody in the organization has an opportunity to make those contributions on it before tax basis it’s called, and i know i’m sorry, i may be skinning a songs you define your jargon, i maybe yes, i’m you’re just skirting just but you won’t, right? You won’t be entered. So it’s called the universal availability rule, which means that, as sort of a zit says sounds that everybody in the organization with again narrow exceptions has to be allowed to make these contributions on it before tax basis. You can’t, they can choose. So this is who you invite to participate in your for three d plan, right? And you have to let them know that they’ve got that opportunity. You can’t keep it a secret on, believe it or not, i’ve seen some cases where they just the employer hasn’t told employees that they’re able to do that. Okay, so there’s that there’s their requirements for taking money out of the plan. They’re called minimum distribution requirements. When you get to be aged seventy and a half, you have to take out. A certain amount, because the iris really doesn’t want you dying with that money to pass it on to the next generation, same age at which you have to start your mandatory required distribution for ira that’s. Exactly right, it’s the same rule. Okay, it seems okay, there are there are other types of what it called nondiscrimination rules. You can’t give a lot of money to the top management a t the on give a lot less money to the rank and file give way give i’m sorry. I mean, make contributions to the plan at a higher level to the top management versus the rank and file. Okay, so they’re not discrimination. Discrimination on exactly can’t discriminate in favor of highly compensated people. Okay, so because this sounds like a very interesting. Now you draft these documents i’m way d’oh, d’oh! It’s good that there are people who enjoy the details of this it’s interesting to me, but i don’t have to write them so but what has to be in there is interesting. What? What? What are the little pieces? Should be so one of the things and this sort of bleeds over into you know things. That can go wrong. I mean, one of the ways these one of the things that you want to put in this document is let let’s say your plan says, were we the employees? They actually the employer i was going to make contributions on behalf of employees of five percent of compensation? That’s a typical plan or ten percent of compensation? You need to define compensation very, very carefully, it’s an area where there are a lot of errors, so some some places don’t want to include let’s say, bonuses some employers don’t want include bonuses some don’t want include overtime in the school world. They don’t want to pay perhaps coaches who get extra money for for coaching. So there is a very easy it’s, very easy to make an error in the way you write out your compensation definition, and then your plan is wrong you’re you’re making contributions on the wrong definition of company, okay? And as you said earlier, the irs is not passing on the correctness or the adequacy of your plan document under this under this correction plan under this period that we have, they’re just making sure that you have a plan. Adopted that’s, right? That under this very narrow piece that we’re talking about now, if you find other errors, let’s say you have the wrong definition of compensation, for instance, and you’ve discovered this. You can go in now, you can go in too. V c p okay, and you can say, hey, we found a mistake. We want to correct it in the correction programme for voluntary correction program under e p c r s and we we don’t, you know, we know we’ve made a mistake, we want to fix it and we’re going to fix it, and then you pay a fee on dh you tell the iris this is how we’re going to fix it now maybe you fix it by giving some people some additional money because you’re definitely comp it definition of compensation said that that you actually should have put in more money, for your definition was too low. There’s added compensation, which means added contribution by the employer correct, right? But now the fee that you paid this is not eligible for the fifty percent off correct only for adopting your plan that’s, right by well, failing to adopt the plan and correcting it. Failing to adopted on time, which was december thirty first, two thousand. Thie only place where you got that little sale. Okay, right? Let’s. See, how long does this does? V c p for the for the plan. Adoption correction. How long does that last? Is it just this year, or do we know? Well, dcp will be indefinite. Okay, cp, that fifty percent is just this year, but they but the process of going into v c p that’s an indefinite program that will be open for a long time. And and actually, there are other programs that the irs they’re going to know that it has said that they’re going to introduce that will work with the cp that will affect forthe brovey plans that this basically this area is evolving. Okay, okay. What is this? You get fifty percent off the penalty. What is the penalty based on how much is it? The penalty is based on the size of the number of employees that you have in the plan. So there’s a there’s a schedule? Um, and it starts at the very low end. It’s? About seven hundred fifty dollars, for really small plans. The penalty penalty. That’s the file gods called the filing fee. They could go into v c p but the penalty and it goes all. The way up to about twenty five thousand dollars if you’ve got a giant plan of ten thousand employees or more. Okay, so it’s based on the number of employees in your plan, is how much you’ll pay for filing fee euphemistically a filing fee, but you’ll get half off that if you’re if you’re adopting your plan newly in two thousand thirteen. Thirty right? If he’s missed the deadline and and this and you do that this year, okay? And that’s, your only issue, you know, if you’re going in with two issues, you know or three issues he found what? Look, i made a couple of other mistakes then that’s fulfill rate, but oh, you can’t piggyback you can’t pick you. You can slide in getting the plan adoption and then add a couple and quietly you’ve got a lot of other errors in quietly, you know? You know, tony have to wake up pretty early in morning to fool the irs. What? You okay? So suppose you adopt your plan, get the fifty percent off on that. And then later on, two months later or two weeks later, then you found other errors in your plan. You could do that, but actually it’s no point, because because the way the cp works and this is a good thing, you don’t pay anymore. If you’ve got one error with exception of this half off thing, you don’t pay anymore if you’ve got one hour or twelve hours, so you may as well just get him all fixed. Oh, so you’ll still get the fifty percent off on the plan. Adoption? Well, the penalty, but you’ll pay full freight on the other. Well, except that what will come out to is what if let’s say, if you go in, you failed to adopt and you’ve got two of the mistakes you’re just trying to game the system. You are, you are. But i guess they think the irs is a step ahead, right? It’s kind of embarrassing teo to sort of sum it up. The only way you get the fifty percent office is if you go in without one mistake that you failed to adopt the plan on time. That one mistake, that one was that the only way you get fifty percent off he’s going with two mistakes, you don’t have to pay the right, but what? Happens if you come in later with the second most? Well, then you’re paying one and a half times, right? You paying the fifty percent and then you’re paying a full fee. So why would you do that? You follow him saying so in other words, the if you if you buy for kate at the way you’re suggesting, then you’re paying fifty percent now and then you’re paying one hundred percent later. If you do both together now, you’re only paying on the feast get the penalty schedule is the same for the different. Oh, i thought maybe they were different now exgagement for different types of errors. No. Same. Okay, so okay. They thought of that. Okay. Um evan gillers, a founding member of the law firm of giller. G i l l e r and calhoun c l h o u n you’ll find them at giller calhoun dot com. Sounds like you should be out in the wild west. I don’t know oklahoma or wyoming. Just that. Calhoun. Well, you know, calhoun happens to be based in denver, so you’re not that far off. Really? Yeah. So this is you have two offices in new york. And denver okay, let’s spend time talking about some of the other errors that that maybe in your plan, you have top five and i think we’ve alluded to some of them, but we’ll make them make them explicit. What are let’s, let’s? Just get started. What what’s? The most common error that you see in in four three b plan. So you know, the most common error that we see again without without getting too deep into the weeds on that? Don’t worry, i’ll stop. You will stop, right? Okay, i’ll get lost, and then i won’t let you lose others. I said earlier that there are two regulators. One is the irs. One is the department of labor and department of labor. Is those those people who are at all involved retirement plans? We’ll know the dreaded a risa word. Arisa is the statute that governs were governed in play that you are, say, e r i s retirement income security act. Very excellent. Okay, okay, so the actual the most common error that we find actually isn’t a risa era and not an internal revenue code error and it’s worth mentioning because it’s a common error and it’s a serious error, okay? And that is when if you have a plan that allows employees to put money in on us on an elective deferral of salary reduction basis before tax basis like we were talking about before you have an obligation to send that money to the insurance company or the mutual fund for using mutual funds very quickly. You can’t sit on that money and let it sit in your bank account and say, you know, i’ll get to it in a couple of weeks. Really, even a couple weeks is not is too long. Yes, a couple of weeks, it will almost always be too long. Yeah, and in this day and age of automatic peril zsystems the department of labor thinks that two weeks is almost you could almost never justify. Okay, so what happens is that people get a little careless sometimes, and maybe the payroll person goes on vacation or they’re just the processes aren’t aren’t in place and the money sits there, and the and the department of labor thinks that’s a bad violation. They want that money going in quickly, because when the money doesn’t go on quickly, it doesn’t. It doesn’t experience investment return it’s sitting in your bank account in your theoretically getting interest on it, a zen employer. So the deal doesn’t like that. You need to be very vigilant about getting that money to your insurance company of mutual fund. What if we’re talking about the united states department of labor? We are right where we are. What if just, you know, like you mentioned your payroll person goes on vacation one time you were you were slow because the payroll person was on vacation and when he or she came back, they’d caught the mistake. But it’s been it’s been the two week vacation because they went, you know, they went exotic, maybe south asia or something took two full weeks vacation. Now they’re back. They realize the mistake, it’s only one time is this. Is this a big deal? Well, you know, you actually it’s a great question for a couple of levels. One is we really didn’t. We didn’t talk about this. I mean, there is a we talked a lot about filing with the irs and the fee and through the vc paid. In fact, when you have small violations on the ira side there’s something called self correction where you don’t have to file violations that fit within their their self correction program. Okay, khun, just be fixed without filing and the it means you don’t have to go and you don’t need to their approval. You don’t need to pay them anything. You just fix him and and i and that’s to a certain extent true with the department of labor to in that case, i would not call it a big deal. But i would say that if you found it, you should fix sit fix. It basically means giving the interest that the participants lost in the period of time that the person was on vacation. That two weeks it’s gonna be a tiny amount of money to weeks of interest on one one contribution you gotta give. Give e-giving. Okay, let’s, let’s hit another couple. We have just a couple minutes left zoho common errors. So another error is on dh. This also goes to what needs to be in the plan. There are these limits that the irs imposes upon these plans about how much money could go in in a year you’re mentioned earlier and they’re they’re two separate limits. They kind of work together, but there’s one limit that’s the total amount that can go in as an employer contribution and an employee contribution and there’s a separate limit that could go in as an employee contribution that’s the seventeen thousand five hundred we talked about the total limit is fifty one thousand dollars oversignt pretty little bit per year. Okay, and i’m guessing that the error is miscalculation. Correct the errors, miscalculation and and then there’s also a ah limit on the amount of money of salary that you can take into account in doing the calculations. So in other words, you say ten percent of compensation you can’t consider any amount of compensation above two hundred fifty five thousand dollars, so i’m making five hundred thousand dollars kazama. You know, i’m the executive director most of that much. Almost half of that can’t be included in my contribution. Okay, we have time for just one more top five. So so another another issue is this minimum distribution issue. You know, actually, i’m gonna go really one where i’m going gonna actually go to another one, which i think is probably more important. Which is loans and hardships. Many of these plans allow participants take loans, and they you can take a loan out of your own account and you have to pay it back. General, have to pay it back over five years a little longer if it’s to buy house or a hardship distribution, which is, if you have something really bad happened to you within the rules of the irs. What the irs considers to be really bad, including medical expenses within a sir. Certain limits. If you have a casualty loss, if hurricane sandy was a good example, if you get the house bilich list and what’s the what’s, the trouble with these hardships, they’re not. So the rules for the loans and the hardships are actually quite complicated, and they are often not applied correctly. Okay, we can we can correct these, though. All through v c p the voluntary correction programme. Correct. Okay. All right. Evan giller, founding member of the law firm giller and calhoun at giller. Calhoun dot com. Evan, thank you very much for explaining this. And being a guest. It was my pleasure. Pleasure to have you. Thank you. Right now we go. Away. And when we come back, tony’s, take two, and then compensation clarity with jean takagi and emily chan will stay with me. They couldn’t do anything, including getting ding, ding, ding ding. You’re listening to the talking alternative network waiting to get in. Are you suffering from aches and pains? Has traditional medicine let you down? Are you tired of taking toxic medications, then come to the double diamond wellness center and learn how our natural methods can help you to hell? Call us now at to one to seven to one eight, one eight three that’s to one to seven to one eight one eight three or find us on the web at www dot double diamond wellness dot com. We look forward to serving you. Hi, i’m ostomel role, and i’m sloan wainwright, where the host of the new thursday morning show the music power hour. Eleven a m. We’re gonna have fun. Shine the light on all aspects of music and its limitless healing possibilities. We’re going invite artists to share their songs and play live will be listening and talking about great music from yesterday to today, so you’re invited to share in our musical conversation. Your ears will be delighted with the sound of music and our voices. Join austin and sloan live thursdays at eleven a. M on talking alternative dot com. You’re listening to the talking alternative network. Lively conversation. Top trends, sound advice, that’s. Tony martignetti, yeah, that’s. Tony martignetti non-profit radio. And i’m travis frazier from united way of new york city, and i’m michelle walls from the us fund for unicef hyre. Welcome back time for tony’s take two again were pre recorded this week, so i can’t send live listener love i feel bad about that. I could guess a couple, i’m sure we have listeners from china ni hao and and we’re also we certainly have listeners from tokyo a bit there live listeners from tokyo and i forgot to have tio how teo konichiwa konichiwa for our listeners in japan and taiwan excuse me about taiwan is out there also where in the u s um, north carolina, california, new jersey, new york i hope i bet you’re out there. I’ll bet you’re out there durney stick to this week i wanted just remind you that i host a monthly podcast for the chronicle of philanthropy, and that is called fund-raising fundamentals. And this month i talked to consultant rosetta thurman about thie cycle in charities that causes fundraisers to be dissatisfied with their work and ceos to be dissatisfied with their fundraisers, which leads fundraisers to bail out of jobs all to the detriment of charitable missions. Now we talk with rosette about the causes and what fundraisers khun due to break the cycle and that’s on fund-raising fundamentals? You’ll find it on the chronicle of philanthropy website. You’ll also find it on itunes, and there are links on my blogged at tony martignetti dot com and that is tony’s take two for friday, the twenty second of march twelfth show of the year. I now have a vintage version of non-profit radio. This is compensation clarity with jean takagi and emily chan. Right now we have jean takagi and emily chan on the line. We have them, don’t we both excellent. Jean is principal of neo the non-profit and exempt organizations law group in san francisco. He edits the popular blogger at non-profit law block, dot com and he’s at g tak gt a k on twitter. Emily chan is an attorney at d’oh and she’s, principal contributor to the non-profit lob log she’s the american bar association’s twenty twelve outstanding young non-profit lawyer and you can follow emily at emily chan at emily c h a n a million gene welcome back. Hi, tony. Hi, tony. Good to have you back. We’re talking this month about compensation because it seems to flow from what emily and i talked about just a couple of weeks ago, so emily, why don’t you? Why don’t you lead us into this from from last month? Sure, so are lots. So he talked about the private benefit rules at at the ad buy squeezed in a very big phrase there the preventable cruise up to the reasonable miss, and we’re going to get not this show, but basically we’re going to look at the penalty that the irish usually while imposed when they find an inappropriate benefit going. Teo insider as we talked about last week, ok, so now we’re really looking at, i guess, practically speaking, the kind of penalties that organizations should be very knowledgeable about and also very wary of so that they could follow the best practices and make sure they’re protecting their organizations. All right, you were cutting out a little bit, emily, but we were able to fix the sound quality. Just say that. Say that. Say that very, very rich and wordy phrase again from from last month that will talk more about just say that again because you cut out a little bit there. Rebuttable presumption of reasonableness. All right, we look forward to getting into that gene. What are the general guidelines? For compensation for and who are we talking about? Whose compensation are we talking about? And what of those general rules? Well, practically speaking, we’re talking about the compensation of the executives, so that would be the executive director or ceo or president, and of the cfo or treasure the organization has compensated, chief financial officer okay? And what are the rules generally, that just that it has to be fair and not excessive, that that’s practically the rule, tony so it can’t be excessive and and the way we try to judge that is we try to look at what comparable organizations air paying, and so the big question is, what is a comparable organization and what is a comparable position to compare? You know who we want to pay to another organization and what what they’re paying, let me throw something interesting at least interesting to me, and maybe you have the legal minds may not find it interesting, but what i do over here, you said it’s only for executives, but what i see in ah lot at colleges and universities, the the highest paid people there are often coaches, sports coach is like a basketball football. Coach at at a big big, you know, big name program, does this this excessive compensation apply to them? Also are on ly to the executives of the organization that’s a great question, tony. Thank you. We’ll bring you back next month. Thank you. Dream the area when we’re talking about big institutions like colleges and universities and healthcare systems and big non-profit hospital, the range of what we call disqualified persons or insiders definitely goes up. People have substantial influence over the organization or a particular segment of that organization. So football coaches will probably be drawn in into that equation when they have a huge influence on on the institution itself. Okay, there are just more general rule beside the what we call the intermediate sanction rule. Their excess benefit transaction rolls the night i go into jargon dale for that. Oh, my god. Yeah. All right. We’re gonna get to that stuff, apparently. And broader doctrines that you could get in trouble for as well. Okay. Broader than just the executive. So it’s so it’s those who can exercise ah, lot of control over the organization, wherever they are, wherever they are in the hierarchy. That’s a good way to think of it. Okay, cool. That’s the late person. I’m gonna turn you, but you wouldn’t know it the way i talk. Okay. Let’s. See, what is this intermediate sanction? Emily what? Intermediate? To what? What’s, the more extreme. So the more extreme penalty comes from the world. We have that last month with private benefit private kermit, we’re technically really the penalty is replication of sabat on that thing’s pretty severe. Especially if a benefit confirmed it was only a little bit more than what it should have been. So what the irs produced then what? Something that they called their intermediate sanctions. Also the excess benefit transaction will which instead of replicating tax exempt status, so actually impose a penalty tax on that access benefits. So it can be suppose both on the insider who benefited. And it usually starts with a twenty five percent penalty talks of the excess amount. But also boardmember should know that they can also be taxed of ten percent of the access amount if they knowingly approve the transaction. Okay, knowingly mean let’s. Just stick with compensation at this point. Let’s not let’s, not get too the xx of benefits we’re just talking about direct compensation, cash, cash compensation. So so boardmember sze, who knowingly approved it meaning meaning they knew that it was excessive, right? So they have actual knowledge of the transaction, and when i use the term access benefit, i don’t mean the stuff on top of what say base salary, just an excess benefit itself, which could be a large compensation o just the way that i used that term in the way that fused with the rules. So um and boardmember, who would be considered knowingly approving such a transaction, would be someone who knows the terms of the transaction. I’m also aware of the possibility that that transaction might be excessive in violation of this excess benefit transactional on and also, you know, failing to make those reasonable tends to figure out whether it is actually excessive, but this goes back to the fiduciary duties of directors and making sure that there, meeting their duty of carrie’s, loves their duty of loyalty and making sure that they’re making informed decisions and that it is in the best interest of the organization by not being something that okay, and we have talked about those those duties those fiduciary duties previously can can these penalties that are levied against boardmember sze can they can they be paid by the organization? I’m generally no. So this would actually be triggered under state law of there are provisions that have to do is indemnification, which is the organization’s ability to cover expenses that would come out to a show like this. They’re being stewed in your capacity as like an officer dirac, the organization and generally that’s. Probably not going to be okay under state law, no matter what. Okay, okay. Let’s. See? Okay, gene let’s, let’s. Turn to you and let’s talk a little about the this the rebuttable presumption of reasonableness that emily mentioned before. What? What what’s that how does that play in here? So these procedures are useful wherever you’re know where you were, you know that you’re going to compensate one of these insiders amount that is not obviously way below market level, but you should go through these procedures just as a general rule. Anyway, if you’re anywhere near paying market rate compensation and their three step, the first step is getting advance approval by the board of directors before you. Enter into that confrontation transaction after the interested party there’s uninterested director in there is going to be compensated abstains from that vote and does not participate in that. Okay. And that would include on executive officer who’s who’s on the board. Because of that position, ex officio boardmember they should they should abstain as well if we’re talking about their compensation. Right? Okay, so you get the advance approval with with the abstention of the person who’s involved what it would else duitz step two is reliance on appropriate comparability data. So we’re looking at comparable salaries from similarly situated organizations for similar positions of similar work. So it’s all about getting the right comparable. It might be done through salary surveys, working with professionals that our salary experts in the non-profit area, or maybe looking at form nine nineties they’re different concerns about just taking other organizations form nine nineties to make sure that the right comparables but a lot of smaller organizations do it that way. What are those? Well, before we go on, what are those concerns about using the nine? Ninety? Well, they might not reflect in the nine, ninety special payments investing of like deferred compensation, though some organizations may look like they’re playing a really high salary, but those were just the result of past things that have been obligations that were paid in the reporting year. So you can’t really consider that a part of the the annual salary, for example, of that executive that showing on the nine, ninety that would not be good. Comparable. Okay, so i mean, can a small charity avoid having to hyre ah, compensation expert to do these comparability surveys? What are the other ways? Or maybe there is no other way. Well, there are some compensation surveys that are out there for free as well. You confined things from charity navigator. And i believe guys start might have some some compensation service for free. You have to be careful, though, because sometimes the ranges of the size of the organization don’t play in your favor. So, you know, they may say, well, this is the average compensation for organizations with annual budget between one million and ten million. And depending upon where you fit in that structure, using the average may not be appropriate for your organization. Right? Okay. Okay. Um and then add a couple more things to the comparability that it’s because you brought a small organization a general rule for organizations with less than one billion and gross receipts toe have at least three comparable so it’s not necessarily there. You know why spread search for comparability data. But tow have three is generally considered reasonable. And another thing to consider is really just giving you an idea of the band wins a salary that’s out there. But it would be problematic for an organisation to just look face purely on numbers and decide ok, just because it fits in the band with that that’s appropriate. I mean, that kind of goes back to your example of the football coaches where sometimes just so skewed that if you keep pushing the upper limit of the band, when you just start to see these ranges leaves up and up and you really do need a look that performance on the duties that are being like that? Yes. Okay, of course. The right, the person’s performance as well. Not just what other people are paying somebody similar in a similar organization. Okay, thanks so much. Thank you. Look at the geography because i know. In manhattan in san francisco, where we are the average salary’s going to be much higher than somewhere in des moines, iowa. Yeah. Okay. Okay. And there’s one more part to the rebuttable presumption. Can you can you explain that in about a minute, gene? Yeah, the third part is just timely. An adequate documentation of the board action. So that means really putting it down in the minutes on getting those minutes approved by the next board meeting. So you just want to make sure that you’ve documented it. And if you’ve got comparable, attach the comparable to the minutes to prove that the board has actually looked at these before making that determination and approval. All right, now that we’ve explained the three prongs of the rebuttable presumption gene, please explain what the hell a rebuttable presumption is. That’s great. What what it does is it shift the burden from your organization, have to prove that the salary is reasonable and shift it to the irs to prove that it’s unreasonable, which the irs doesn’t want to do because it takes a lot of work. So if you just go through these procedures, you kind of put a big barrier to the irs to go after you brew for paying excessive amounts because you say i’ve used the procedures that treasury regulations have approved this is the way it should be done in the iris used to get it back off at that point, unless they think they have a really big fight. So then write if you follow these procedures, the compensation is presumed to be reasonable. But the irs has the option, although it’s unlikely that it would exercise it to rebut that presumption and try to prove that the compensation was unreasonable. Is that right? If they want to take it to court, if there were. Okay. Okay. Likely. Okay, but it’s presumed rash reasonable if you follow the three prongs that you laid out, correct. Okay, we’re going to take a break. And when we come back, jean and emily and i are going to a little role play exercise, we’re going to be the board of directors and we’re going to decide on somebody’s compensation. Um, i don’t know. One of you two is going to chair the meeting, so you’re welcome over this break to figure out who that’s going to be. And i’m going to be a boardmember and then the other person be boardmember, too. So stay with us for that role. Play exercise. Don’t know what’s going to happen. I hope you’ll stay with us. You’re listening to the talking alternative network. Duitz are you stuck in your business or career trying to take your business to the next level, and it keeps hitting a wall? This is sam liebowitz, the conscious consultant. I will help you get to the root cause of your abundance issues and help move you forward in your life. Call me now and let’s. Create the future you dream of. Two, one, two, seven, two, one, eight, one, eight, three, that’s to one to seven to one, eight one eight three. The conscious consultant helping conscious people. Be better business people. Buy-in have you ever considered consulting a road map when you feel you need help getting to your destination when the normal path seems blocked? A little help can come in handy when choosing an alternate route. Your natal chart is a map of your potentials. It addresses relationships, finance, business, health and, above all, creativity. Current planetary cycles can either support or challenge your object. Dafs. I’m montgomery taylor. If you would like to explore the help of a private astrological reading, please contact me at monte at monty taylor dot. Com let’s monte m o nt y at monty taylor dot com. Talking alternative radio twenty four hours a day. I got more live listener love laurel, maryland bend, oregon, and tokyo welcome to our second listener in tokyo. We got more tokyo listeners than we have oregon or south carolina or north carolina listeners maurin tokyo than most other states listening. Okay, jean emily, we’re talking about compensation, compensation, clarity, and we’re going to our role play board board meeting now. Who’s the chair. I’m okay. Genes the chair. Emily, you and i are board members or way just regular boardmember zor is one of our compensation under discussion or what? I think we’re about boardmember okay, but neither of us has our compensation under consideration that person’s removed. Okay. All right. Go ahead, gene. You’re gonna share the meeting, okay, tony so right now we’re talking about approving the compensation of the candidate who is going to be our executive way, didn’t approve. We didn’t prove last month’s meeting meeting minutes. What kind of what kind of foisting? Of ah, fake what? We didn’t approve last minutes less months. Amina melkis consent agenda earlier, tunney and now we’re on the second part of our meeting. We’re okay. All right, go ahead. I’m taking my time taking my fiduciary. Duty very seriously. I want you to write that care, loyalty and what’s my third fiduciary duty. Besides karen loyalty, a lot of people like this, they obedience. Obedience. Okay, well, i’m not all right. Well, i mean, i’m failing on three, but but i’m taking my first two very seriously. All right, go ahead. Emily. Emily obviously doesn’t care, but she’s like lester, let me see lackluster boardmember i hope your term is up soon. Emily all right, okay, so we’ve got an executive director that we need to hire, and this executive director is pushing us for a salary of one hundred thousand dollars and the possibility of bonuses of up to twenty thousand dollars for pizza. We’ve got a million bucks in our budget, and we’re not really sure whether approve this compensation or not. He looks like a great candidate, but there’s some other candidates out there as well. What do you think, tony? Should should we hire this person that the salary they’re asking for? Well, do we have any comparable data by organizations that are similar to ours? Go thin geographics and also annual budget on dh with that data also be comparable in terms of this person’s responsibilities. Emily, i think you were convicted. You right? Collecting this data? Yeah. So i researched some organizations that of similar type similar size and similar roles of executive directors. And i found three different data points. So, uh, one and these they’re all in our geographical area. One is eighty thousand one. Report ninety thousand and another one report. One hundred and ten thousand. Okay. We’re looking at one hundred thousand with the possibility of a twenty thousand dollar bonus. What do you think, tony? Um, i guess the bass sounds or so we have. Eighty ninety. First of all, i’m assuming that emily knows what she’s doing when she says that these things are similar and putting a lot of faith in her because i could be personally liable if this turns out to be excessive compensation. Um, only if you know that it’s expensive. Funny, but that’s. All right, that’s. Right. Okay. Raise a good point about the line. What do you need? A reliable source. Okay, well, your outstanding young lawyer. So i’ll assume that you’re on. You’re on the board. Very in doing this. Surveys what i brought to the board. Meeting and we’re going to attach them to the minutes of the okay, i like the i’d liketo like the base of one hundred. I’m not sure about the extra bonus of twenty family. What do you think about that extra bonus of twenty when the high of our comparable is only one ten? I don’t think it’s necessarily problematic if we have adequate justification for allowing that for example, if thiss opportunity with this executive director is probably going to pass us by, we are in a bind because we’re now doing an executive director succession that we didn’t anticipate and the organization’s going to be really hurt if we don’t find somebody who’s qualified and this is the most qualified person we found and we’re actually getting a really good deal for this person and it is discretionary, so it’s going to be up to the board at the end of the year and we have put a limit on it, you know, maybe we should evaluate again looking at our revenues and looking again at the comparability data whether twenty thousand is reasonable, but i’m not opposed to putting the opportunity of a bonus into the contract. Right now, that’s. A bunch of malarkey. I’m walking out of this meeting. Did you hear me? Did you? My footsteps and i just slammed the door closed. I i’ll propose i’ll ask to see if there’s a motion to approve a one hundred thousand dollars based salary with a possibility of a ten thousand dollar bonus. And we will actually look at the possibility of a further ten thousand dollar bonus if we hit certain revenue goals that might allow us to look at other comparable, do you think that’s reasonable? All right, i’ll come back into the meeting. All right? I’ll go along with that. We have to wrap up our meeting very quickly. Yes, i would approve that. Okay, so family makes the most money. Wilbekin were approved. We’ve got it as a draft that being the diligent boardmember i am just a reminder that we need to have adequate documentation and our board minutes. So i’m going to write down the terms of the transaction. We approve the date it was approved, the board members that were present during the debate who voted. I’m also going to attack the comparability data on there and as well document the fact that we followed our conflict of interest policy and removed the executive director from the conversation that was emily chan she’s, an attorney at neo non-profit exempt organizations law group and our board chair was jean takagi he’s, the principal of neo. You’ll find them both blogging at non-profit law blogged, dot com, gene and emily, thank you very much. My pleasure, thanks to my guests this week, evan giller and emily chan and jean takagi next week, aziz said, i’m recording this show weeks in advance, so you’ll i don’t know what’s going to be on here the twenty ninth completely, but have i ever let you down? I have not. So hopefully you don’t think i have let you down? I do know, scott koegler will be with me on march twenty ninth. You can count on that good old scotty will be here. He’s, our technology contributor and the editor of non-profit technology news what’s he going to talk about the man is only human. I can’t ask him this many weeks in advance, but has he has? Scott koegler ever let you down? We’re all over the social web, but you can’t make a click without sparkle a testa smacking your head into tony martignetti non-profit radio itunes, facebook, youtube, twitter, linkedin, four, square pinterest. Slideshare facebook. If you’ve been to the facebook page lately, if you love the show, please like the facebook page and more of our information will get into your news feed. Our creative producer is claire meyerhoff. Sam liebowitz is our line producer on the assistant producer is janice taylor. Shows social media is by regina walton of organic social media and the remote producer of tony martignetti non-profit radio is john federico of the new rules. Oh, i hope you will be with me next friday, one, two, two p, m eastern on talking alternative broadcasting at talking alternative dot com. Oppcoll i didn’t think that shooting. Good ending. You’re listening to the talking alternate network. Duitz get him. Thing. Good hi, i’m donna and i’m done were certified mediators, and i am a family and couples licensed therapists and author of please don’t buy me ice cream are show new beginnings is about helping you and your family recover financially and emotionally and start the beginning of your life. We’ll answer your questions on divorce, family court, co parenting, personal development, new relationships, blending families and more dahna and i will bring you to a place of empowerment and belief that even though marriages may end, families are forever join us every monday, starting september tenth at ten am on talking alternative dot com are you suffering from aches and pains? Has traditional medicine let you down? Are you tired of taking toxic medications? Then come to the double diamond wellness center and learn how our natural methods can help you, too? He’ll call us now at to one to seven to one eight one eight three that’s two one two seven to one eight one eight three or find us on the web at www dot double diamond wellness dot com we look forward to serving you. You’re listening to talking alternative network at www dot talking alternative dot com, now broadcasting twenty four hours a day. This is tony martignetti aptly named host of tony martignetti non-profit radio big non-profit ideas for the other ninety five percent technology fund-raising compliance, social media, small and medium non-profits have needs in all these areas. My guests are expert in all these areas and mohr. Tony martignetti non-profit radio fridays, one to two eastern on talking alternative broadcasting are you fed up with talking points, rhetoric everywhere you turn left or right? Spin ideology no reality, in fact, its ideology over in tow. No more it’s time. Join me, larry. Shock a neo-sage tuesday nights nine to eleven easter for the ivory tower radio in the ivory tower will discuss what’s important to you society politics, business it’s provocative talk for the realist and the skeptic who want to know what’s. Really going on? What does it mean? What can be done about so gain special access to the ivory tower? Listen to me very sure you’re neo-sage tuesday nights nine to eleven new york time go to ivory tower radio dot com for details. That’s, ivory tower radio dot com e every time i was a great place to visit for both entertainment and education listening tuesday nights nine to eleven. It will make you smarter. Talking dot com.