Obama’s 2012 budget proposal is out and it revives the charitable deduction limitation for wealthy donors.

That means we’ll have to listen to the doomsayers, like Independent Sector’s Diana Aviv, exclaim how devastating this will be to the nonprofit community. From last December, here’s a preview of what we’ll hear very shortly. The only nonprofits she speaks for in that article, “Nonprofits Fear Losing Tax Benefit,” are the members of Independent Sector.

I’m thinking of the other 95%, the vast majority of nonprofits who don’t care because they don’t have donors, or many donors, who earn over $250,000 a year, the income at which the deduction reduction would kick in.

We know that tax incentives are not people’s primary motivation for giving. Altruism is. We know that giving always bounces back after depression, recession and tax changes that depress it. This will not destroy the nonprofit sector.

Can’t we trust our donors for Pete’s sake?

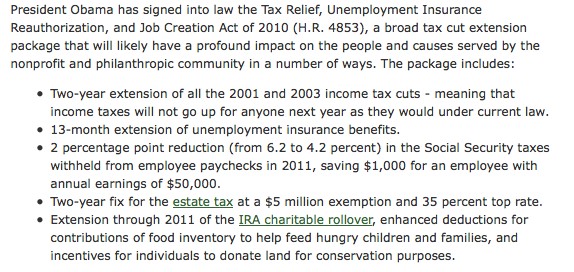

On the day the President’s proposal was released, here’s what Independent Sector had on its home page:

I remember that. It was about two months ago, and it all sounded quite good for charities, including the 95% unheard “minority” that fundraise from low and middle income donors. Charities scored big in December. Do we have to score big again in 2012?

Why can’t the vocal nonprofits step-up this time and say, “Well, we don’t love it, but we’ll do our share to help reduce the deficit that, in small but noticeable part, the charitable deduction has contributed to for decades. Plus, we got these bennies in December 2010 so we’ll sit out this round.”

Doom-and-gloomers: stop squawking. Spend your lobbying money and strategy time visiting prospects, reminding them how critical your good work is, and soliciting and closing gifts.

The most foresighted charities will stand out from the crowd, and publicly proclaim, “We accept the charitable deduction reduction. We want to do our part to help America’s recovery.” I see a full-page ad in The Times with a hundred CEO signatures. Their donations will triple. Run it in The Journal and donations will quadruple.

I trust America’s altruism. I base my trust on history. (Should “God Bless America” be playing in the background? I hear “This Land Is Your Land.”)

As this gets posted the day after Obama’s proposal was released, I could be wrong about the doomsayers. Maybe they’ll come around and accept what’s fair. If they do, look here for my congratulations and apology.

Thanks, Michael.

I don’t agree with the doomsday scenarios. Charitable deduction eliminated? I still believe in America’s altruism. History has proven it.

There is no way to predict how taxes will go. With anti-tax deficit hawks in the majority in the House, and Tea Partyers gaining a voice, there is too much uncertainty to call that.

GDP as a predictor of giving? There are many motivations that go into giving that I’m skeptical GDP can capture: love of charitable works; desire to give back to society; teaching philanthropy to children; leaving a legacy beyond death; memorializing oneself or ancestors; ego; prestige; helping those who have less; gratitude; tax benefits and other financial incentives.

Saying this will be devastating to the nonprofit sector does not mean it will be devastating. You’ve said you disagree with my opinion and now I’ve said I disagree with yours. That really gets us nowhere. It’s a straw man.

Lots of sectors in our economy are hurting. I think the charitable sector can show leadership by engaging in dialogue to bring in something we can live with. Digging in with doomsday scenarios is not productive–and is becoming a tired refrain.

There are a number of reasons the nonprofit sector should be very concerned about the fiscal policy developing on Capitol Hill. First, the proposed Obama budget for FY2012 has a long way to go before a final version is adopted by Congress. So, the reduction in the charitable giving tax deduction we see today may actually look quite different in the final budget. In fact, there are a number of different proposals floating around Capitol Hill concerning the giving deduction ranging from complete elimination to a more drastic alteration than the President has proposed. Therefore, it is not unreasonable for the nonprofit sector to remain vigilant. (I’ve reviewed a number of the other proposals at http://MichaelRosenSays.wordpress.com.)

Another issue with emerging fiscal policy is that it very much looks as though the tax burden on individuals will grow. Neither Congress nor the Administration seem poised to make drastic spending cuts the way the British, Irish, or Greeks have. So, the only alternatives are to raise taxes or let the deficit balloon even further. Of course, over the long haul, like it or not, reducing our deficit will likely require both spending cuts and increased taxes. Because people make current donations out of net personal income, a reduction in personal income, courtesy of a higher tax burden, will likely mean reduced giving.

Finally, overall philanthropy is correlated most closely with Gross Domestic Product. As most economic forecasters predict slow growth, if any, in the coming years, we can expect the same will be true of philanthropy. A reduction in the charitable giving deduction along with a sluggish economy and an increased tax burden for most individuals does not bode well for the nonprofit sector. Being concerned about this is not just whining. Pretending the nonprofit sector is not facing a problem does not 1) mean there is not a problem, and 2) does nothing to address the problem.